MISSION

Our Mission is to offer the highest-quality, customer-focused banking services to our clients and to create value for our shareholders.

CORE VALUES

COMPETENCE

We will be efficient and effective in our work to give our best each day.

CREATIVITY

We will come out with innovative ideas in providing solutions to our customers’ needs.

CANDOUR

We will act with honesty and integrity in all our activities.

COLLABORATION

We will cooperate with each other to give the best service to our cherished customers.

COMMUNITY

We will contribute to society by being active, responsible and generous members of the communities we find ourselves in.

COMMITMENT

We will be committed to quality in all our endeavours and to the ideals of this great institution.

CUSTOMER SERVICE EXCELLENCE

Above all, we will ensure that we always exceed the expectations of every single customer, every single time.

OUR HISTORY

Download Centre

Our Tariff Guide & More

For additional questions, contact us

Get in touch with us

info@nib-ghana.com

THE BEGINNING

The history of the Bank can be traced to the end of the Second World War (WWII). Agitations from the indigenes against foreign imports led to a general boycott by the local population led by the Association of West African Merchants (AWAM). The colonial administration decided to establish an entity that would facilitate the involvement of private indigenous persons in business. The Gold Coast Industrial Development Corporation (GCIDC) was therefore established in 1952 with budgetary appropriations to enable it provide financial support to the indigenes for the establishment of their own businesses.

The Gold Coast Industrial Development Corporation (GCIDC), encouraged entrepreneurship among the indigenes in the areas of furniture making and baking. This intervention helped develop the skills of the local carpenters and bakers in the use of mechanized saw mills as well as electric bakeries. GCIDC also upgraded the skills of people who were washing garments, etc manually by mechanizing laundry activity considering that the Gold Coast intelligentsia were shipping their suits to the United Kingdom for laundry.

The Act also paved the way for NIB to set up joint ventures because the Ghanaian manufacturers or the private sector did not have the required funding for start-ups. NIB however, could lend to enterprises and put in equity. NIB set up over 100 joint enterprises including some of the defunct regional development corporations. Most of the major existing industries including Nestle Ghana Limited, Novotel (now Accra City Hotel), Kabel Metal (now Nexans Kabelmetal), Aluworks benefited from equity participation or funding.

DEVELOPMENT OF COMPETITOR BANKS

NIB’s immense support to the agro-processing industry, in 1965, inspired the transformation of the Agricultural Department of the bank into the Agricultural Development Bank.

As a result of its expanding services to the corporate sector, NIB saw the need for a specialized banking and set up a Merchant Bank to concentrate on trade finance.

The defunct Merchant Bank (now Universal Merchant Bank – UMB) was a joint venture with NIB.

TRANSITION TO COMMERCIAL BANKING

Considering that NIB was at the time not mandated to take deposits, there were annual appropriations from the National Budget to run the bank.

In 1975, following the enactment of NRCD 316, NIB obtained the mandate to start taking deposits only from the companies it had financed, but not from the general public. This was to ensure that the Bank adhered to its core mandate of providing development finance for industries. However, by 1980 NIB was offering commercial banking in order to complement its development banking services as a result of the problems associated with raising term-capital.

The Bank initially borrowed from agencies such as the World Bank, IFC and EU. But in the 1980’s the economic situation in Ghana was not conducive to access external credit. To address the situation, local deposits were mobilized to fund industries.

NIB did not lose sight of its core mandate of development banking and though the Bank had taken steps towards commercial banking, its primary objective was to continue supporting local industry.

NIB NOW !

Currently, 70% of the Bank’s portfolio is made up of loans to the Ghanaian private sector. NIB is a major lender to the Manufacturing, Building and Construction and Agro-processing sectors as well as the service industry.

NIB now operates as a Universal Bank focusing on development/commercial banking activities. The Bank has undergone management, institutional and financial restructuring, which has strengthened the organization. It now, has 48 Branches and 3 Agencies nationwide.

NIB previously participated in foreign lines of credit, which were administered by the Bank of Ghana to meet Term Loan and Working Capital needs of the Bank’s customers.

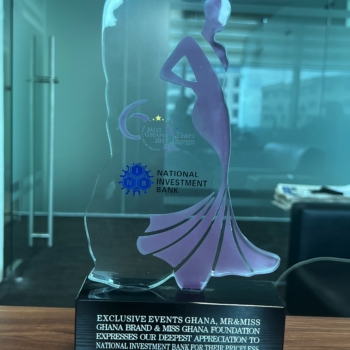

Awards

2021

CIMG Award

2016

1st Runner Up, Best Bank in Household/Retail Banking

2015

West Africa Awards, Best Investment Bank – Ghana

2014

Gold Award, Ashanti Financial Services Excellence Award

2013

Best performing DFI in Africa, (AADFI) awards

2012

Corporate Ambassador for Customer Service Excellence at the 3rd Ghana Customer Service Week Celebrations

2010

Gold Award, Industrial Finance, Ashanti Financial Excellence Services Award

2010

Silver Award, Agricultural Finance, Ashanti Financial Excellence Services Award

2005

Best Bank in Support of Industries – INDUTECH

2005

Silver Award, Best Bank, Industrial Finance – Ashanti Financial Excellence Services Award

2004

Most Socially Responsible Bank – Ghana Banking Awards

2003

Best Bank – Ashanti Financial Excellence Services Award

2003

Best Bank in Long Term Loan Financing – Ghana Banking Awards